Debt recovery is an emotive industry. There are two sides to every debt. With that being the case, assessing a debt is a must for all recovery companies. Not doing so can result in difficult, hurtful situations. Recently, a debt collector employed by Virgin Mobile attempted to collect a bill for £38. The debtor was a man who’d attempted to cancel his contract months prior.

Dementia sufferer

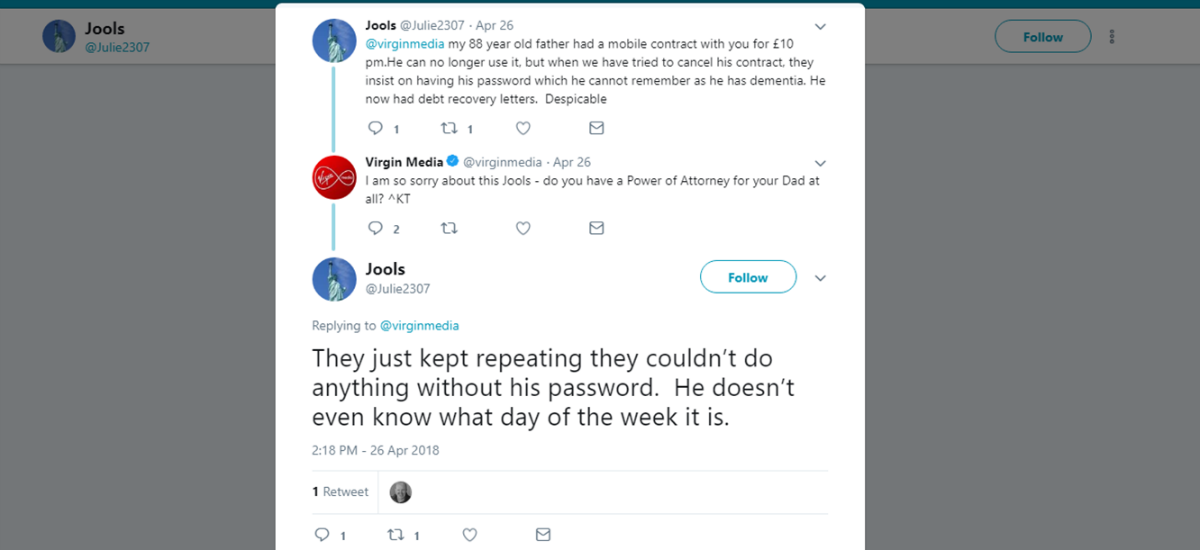

Ken Harkins, an 88 year old dementia sufferer has stopped using his mobile due to his condition. His family attempted to cancel the contract for moths, but was unable to do so due to a password issue. With Ken suffering Dementia, he had forgotten.

When the family of Ken tried to cancel the direct debt, Virgin Mobile continued to let the balance build. After some time, a third party debt collector acted and Ken received letters. On the letters were standard messages that an unpaid balance could resort in further action. In this case however, getting to this stage should not have happened with the situation as it was.

Only after making the situation public, Ken’s family were able to get the debt cancelled. Virgin released a statement saying they’d cancelled the balance “as a token of good will”.

Due diligence

It is vitally important in debt recovery to fully assess the situation. Both Virgin Mobile and their recovery company should have picked up on the attempts to cancel the contract. 2 issues with the debt would tell any collector the debt shouldn't require any action:

- Ken's family had tried to cancel the contract months prior

- The debt value being a meagre £38

Often, debt recovery companies will have minimum debt values (as we do at AYOM). This ensures the cost of recovering the debt isn’t more than the debt value. Attempting to collect for these values is wasteful of resources.

A debt recovery firm should also conduct checks on the debt before accepting it. In some cases the debtor may have already tried to settle the issue. Circumstance could also dictate if debt has been generated unfairly. In this particular case; the family tried to resolve the contract but met resistance due to the password problem.

Even when working with large firms with hundreds of debts each month, it is important to assess each case thoroughly. In this example, that hadn’t been done.

Expect better

As winners of numerous awards in the recovery sector, AYOM are saddened to see such cases crop up. It is our mission to ensure we are the industry standard through our core values which are:

- Integrity

- Commitment

- Empathy

It is because of our values and how we conduct ourselves that we have won a number of accolades including:

- UK Debt Recovery Firm of the year 2017 – Wealth & Finance Intl

- Leaders in Debt Recovery 2018 – Wealth & Finance Intl.

- Debt Recovery Service Providers of the year 2018 – Corporate Livewire

Get in touch

If you are a creditor needing expert debt recovery, contact AYOM. Our team are waiting to talk about what we can do so give us a call on 0800 130 3357 or email enquiries@ayom.co.uk for details.

We conduct due diligence and fully assess debtors before we proceed. You can be sure if we begin work, that we are your best chance of recovering 100% of your money.