Should you solve one debt by taking out another? Financial advisors are likely to say no.

Spiralling debt is an easy trap should you take this road. It is this however, that HMRC are now saying people should be doing. Those struggling to pay tax are now being advised to take other loans to cover the shortfall.

Non preferential creditor

In 2002, HMRC lost its status as a preferential creditor. This meant HMRC was as important as unsecured creditors in a bankruptcy or liquidation case. The aftermath of that has spawned some issues. Just this year, councils have been taken to task for aggressive collection strategies to get back their unpaid money. This has sparked debate about whether losing preferential status has turned local authorities into harsher entities.

It has always been advised that the best method to reduce debt is sound financial management. Finding affordable repayment plans and gradually reducing the deficit. By planning this way, the debtor can live a normal life and the creditor will see money returning.

This is the style adopted by AYOM as we collect consumer based debts including credit cards and payday loans. Debtors do need to pay, but they also need to eat, maintain shelter and live within their means.

Local authorities heading straight for court based collection are omitting the human element to debt collection. Those struggling to pay taxes may struggle to pay a lot of their debts. When this is the case, it pays to work with the debtor to find a solution. Strong-arm tactics from the beginning will be met with either resistance or reduce the debtor to potentially suffering mentally as a result.

Paying debt with debt

In an unusual move, HMRC have written to those with outstanding debts, urging them to pay via any means necessary. This includes taking personal loans, commercial loans or even selling off assets. The advice is essentially; pay off one debt with another. While the HMRC is supposed to help manage tax repayment in the form of reorganising tax codes and offering credits, this ‘advice’ throws shade over that reputation.

Last year, HMRC considered a ‘6 week breathing space’ idea. The idea was to give heavily indebted people a 6 week gap to organise repayment without fear. At the time this seemed a good move to consider. However, the recent letters to debtors asking to seek more debt to pay HMRC has caught the ire of many financial commentators. Phil Manly of DSW Tax Resolution told press:

“People are in that position because of financial difficulty and HMRC knows that. Asking them to take out more debt is effectively destroying their finances.”

StepChange representative Peter Tutton also commented, stating: “The Government should aspire to the highest standards of practice in debt collection and enforcement. They should use enlightened techniques that encourage and help people to repay debts. They should be repaid on an affordable basis over time.”

If HMRC really are asking to fund their debt with other debt, it could be seen as suggesting they really are a preferential creditor without officially being one.

Debt is personal

Every debt is different. It is an undeniable fact. Every debt has a story. Our job as debt collectors is to find the best solution after listening to both sides. The HMRC letters muddy that relationship by telling debtors they are more important than any other debt they owe.

If a debtor owes a local tradesperson, window cleaner, milkman or other small debts, HMRC is telling these creditors they are not as important. Small debts can create big problems; for both parties.

Debt is a personal matter. It matters greatly to both sides. We commonly see that the smaller the debt, often the more it means. The self employed and those who borrow money from friends or family can quickly find a debt becoming personal. Small amounts matter to individuals and while HMRC can continue to operate if an individual is behind by £1,000 on certain taxes, a local trader may need their £100 back to help towards their rent or living.

AYOM Managing Director Mr Logan commented on the nature of the letters.

“We’re quite shocked to see that HMRC would request debtors manage debt this way. Consumer debt, including taxes need to be tackled with a level of care. It is so important to mediate and converse to find a solution.”

“There is no quick fix with debts of this nature. Attaining more debt and insinuating the HMRC is more entitled than any other creditor is wrong. Independent creditors’ money is just as important as that owed to the government.”

“Even if debtors attempt to find personal or commercial loans, with outstanding debts and tax, they are already subprime lenders. Unless they are given astronomical interest rates, new debt would be highly unlikely to be given by any lender.”

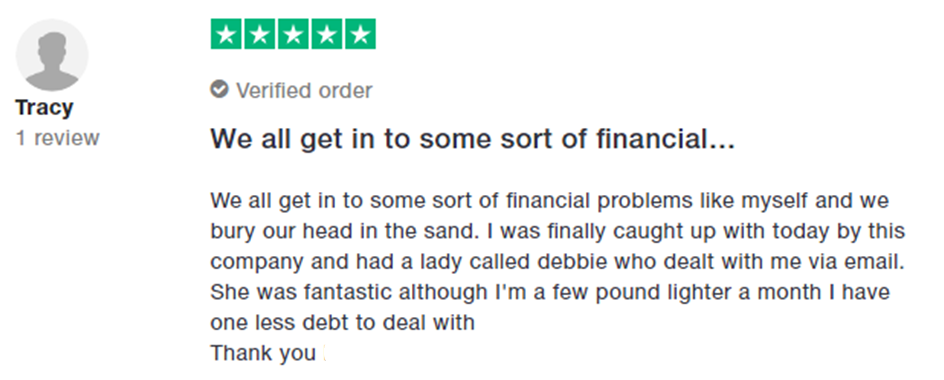

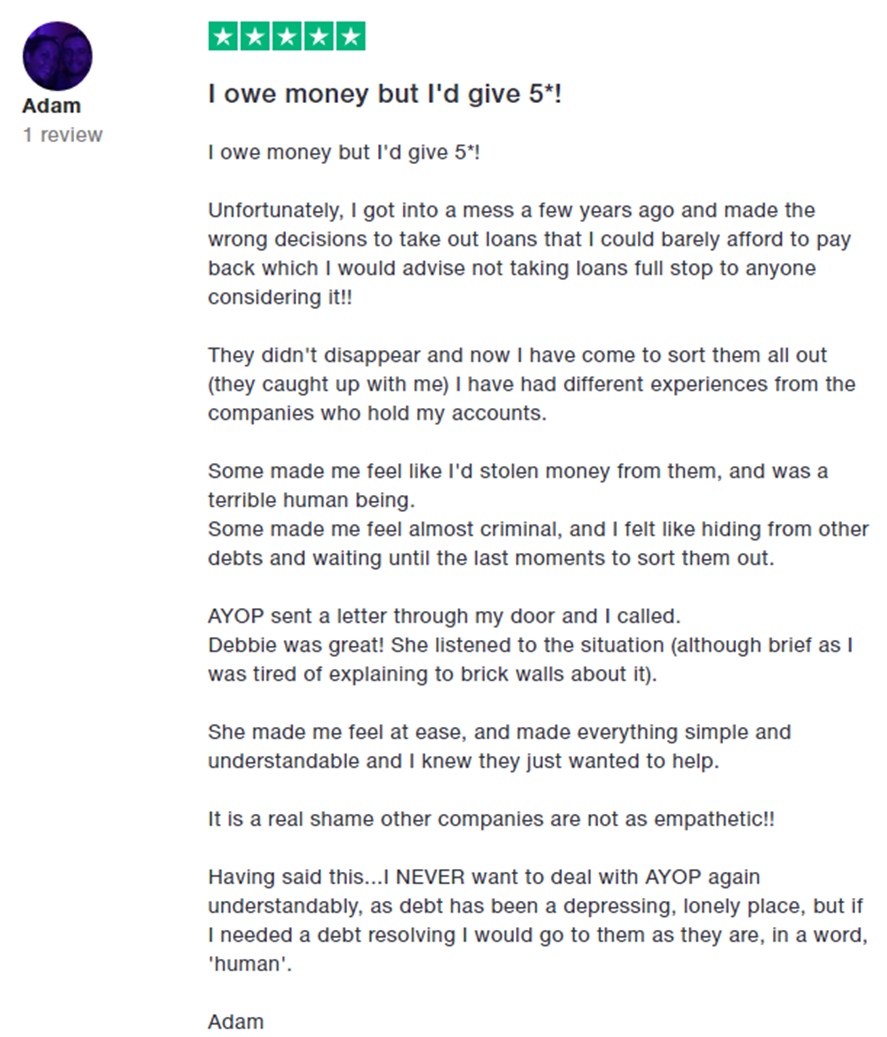

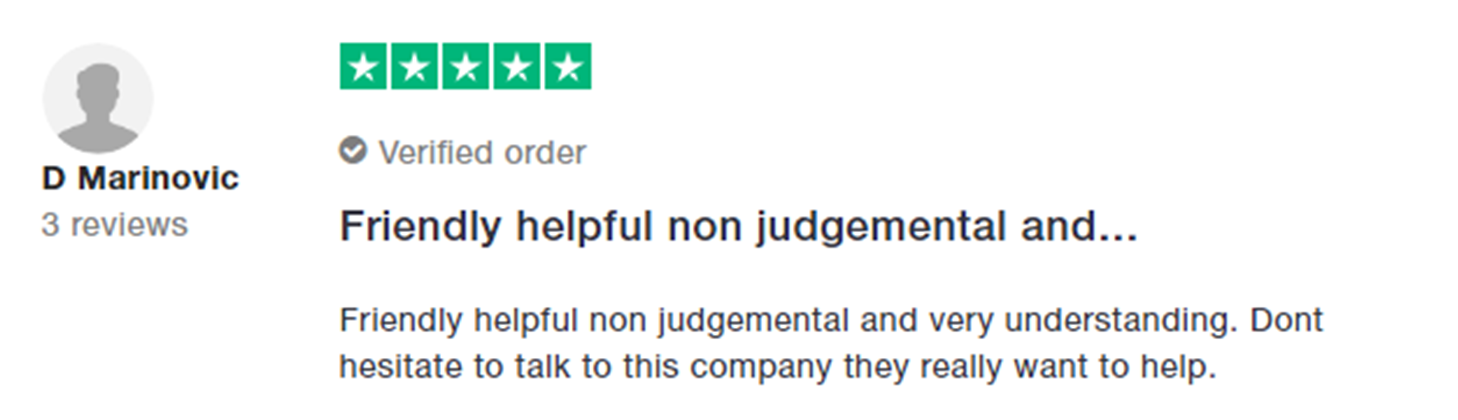

AYOM prides itself on handling debtors with respect and a human touch. We undertake debt collection for a number of businesses owed money by consumers. These debts must be managed by a team embodying our core values of “integrity, commitment and empathy”. Unlike strong handed tactics pursued by authorities recently, our methods have proven very successful. So much so that debtors alongside our clients have been happy to review their treatment on reporting platforms.

What can be done?

Tax falls under personal debt. Debts owed by a person or household. Rather than risking further debt, debtors must be helped to find a solution. It is better to receive payment over a longer period, in full, than overstretch a debtor to breaking point early and receive a few larger payments. If larger payments don’t repay the debt immediately, it could end up in a bankruptcy situation. It could also affect debtors’ mental health and general wellbeing. For a more detailed look at debt and mental health, read our blog from last month on what part we play as collectors.

In our line of work; yes, money is always owed. But, to ensure everybody leaves the situation with a burden lifted, we must work WITH those who owe.

Debt is about mediation.

Debt is about effective money management.

Let’s not push debtors to breaking point by seeking more debt and plunging further into trouble. Let’s find solutions, plan strategies, and help educate those in trouble to reduce the chances of falling into hard debt in the future.