It sounds like the ideal situation. You are owed money; a debt collection agency promises to chase it. Not only that, but they also do it on a "no win, no fee" model. Perfect! Zero risk or money you need to pay right now, and if they don't get it back, then nothing lost, right?

Unfortunately, it isn't quite so simple. No win, no fee debt collection can seem like a great prospect. But when you dig deeper into how it works, it could be that it is more trouble than at first glance.

Here's 5 points as to why looking for no win no fee debt collection could hinder your chances of collection.

What is no win, no fee (NWNF) debt collection?

No win no fee debt collection is undertaking a debt for collection for no up-front fee. It doesn't mean that there will be no fees. The most common fees are attached to the back end of the recovery, after successfully collecting the money. The percentage charged changes from company to company and can be considerably high given no initial cost.

For any debt, it is very tempting to pass on your case to a debt recovery company operating this way. They will take your debt, work it, and if they are successful, you'll receive your debt minus their fees. If they aren't successful, you don’t lose any further money chasing it. It's a simple model and one that may work in some circumstances. Most notably, debts that are difficult to prove in court such as personal disputes or debts lacking evidence. There's little chance of recovery in these instances but a few letters or phone calls could generate some level of response. It is, however, low risk, low reward. It is not entirely without merit; however, we would always advise certain debts to opt away from this model.

How does it differ from other debt collection services?

Are You Owed Money Ltd and similar debt collection agencies will be asked the question regularly:

“Do you do no win no fee debt collection?”

Our answer is always the same:

“No, but, here is why…”

Our model of debt collection is that we treat all customers equally. We charge an up-front fee; a small amount added to the debt value upon instruction. This means once the debt is recovered in full, your up-front fee will be returned to you.

The up-front fee allows a debt recovery agency to set up their strategy and begin chasing the debt. This isn't enough to cover the actual costs of recovery, but it ensures that no matter the value, age or difficulty of recovery, you will unlock the full recovery strategy without additional extras or limitations. Your debt will be chased using every available strategy and using all tools at our disposal whether you are owed £200 from a personal dispute, £2,000 from work completed and not paid or £2 million from a business debt.

So, why is no win no fee inferior? Let’s explore our 5 main pitfalls of adopting this approach rather than a normal debt recovery agency.

1. Your debt will be chased for a finite (small) amount of time.

For no win no fee debt collection, the key to being successful is results. Every single debt is different. There are so many variables that determine how hard a debt will be to recover; in some cases the way to ensure a result is time and consistent pressure. To be able to make money, a no win no fee debt collector requires a fast result. If your debt looks like it will not become a quick win, there is no reason for them to continue chasing. They often run a case strategy for a set time (Often only a few weeks or a month) and close the case. This can even include if a payment has been made. For them, part payment is better than no payment, and if the additional payment is going to take more time and effort, it is not worth it when fresh, new debts come in.

2. If your case is difficult to chase, there's no benefit to working harder.

As in point 1, no win no fee requires success to be sustainable. Some cases are much easier than others to collect. This comes down to the value, the evidence, the type of debt. It even matters how much the debtor is willing to talk. If the debtor makes no effort to engage, it doesn’t help a no win no fee debt collector achieve a result. Using an example of a valid debt, it is £500 and there is evidence to support. However, when the debt collector makes contact, the debtor simply ignores or tells them there is no debt and to take it to court. A no win no fee company will more than likely make a few more attempts at contact before writing off the case. While your debt may be recoverable, it is beyond what they are prepared to work for as other easier debts are available.

3. Added fees for extras and collections fees after the initial period.

No win no fee generally means "no up-front cost". It doesn't however mean the service is free. In many cases, if you want additional work beyond the most basic functions (sending emails, telephone calls) or after the initial period, you may have to pay an additional up-front fee.

Would you like doorstep visits adding? — That will cost extra.

Would you like a legal letter sending? — That will cost extra.

Would you like telephone support? — That will cost extra.

Alongside the back-end collection fee of success, no win no fee often includes just the bare minimum of collection strategy. It is in their interest to get a result quick and if that is not forthcoming, it will not be pursued. It is not uncommon to see no win no fee debt collectors simply send 1-3 letters, emails and phone calls, before deciding a case is not worth pursuing. If you want a debt collector to maintain pressure, escalate proceedings and remain invested in your debt, no win no fee may not be the answer.

4. The value of your case will affect it's priority.

You may be seeing a common theme among the potential pitfalls. The easier a debt is to collect, the more money a debt can potentially bring to a no win no fee company, the better. Any slight deviations from this can render your debt on the backburner. None Moreso than the biggest contributing factor… Debt value.

How much your debt is worth determines how much commission a no win no fee debt recovery agency can claim. Do you have a single debt worth several hundred pounds? The person who enquires after you with a few thousand pounds is worth more to them. If that is you, great news… Until the person with a few tens of thousands worth makes an enquiry. Not a problem if that is you… Unless somebody then enquires looking to recover a few hundred thousand. The story continues.

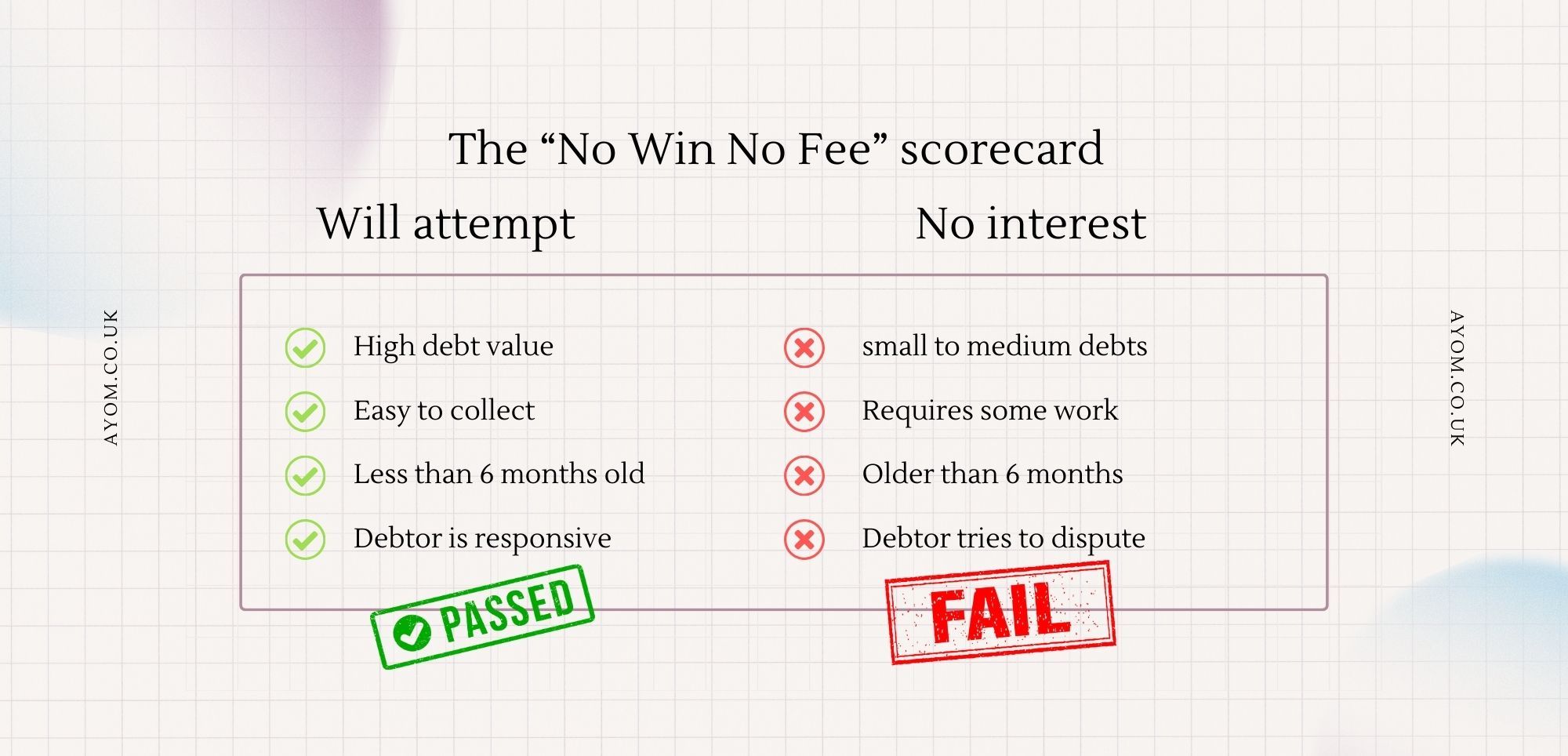

Consider no win no fee debt priority as a scorecard system. The higher value the debt, the easier to collect, the newer it is, the better. If your debt is anything less than “excellent” in any of those categories, you may be left waiting while more “important” debts are collected that make the debt agency more in commission, faster.

5. No legal reviews or escalation possibilities.

No win no fee is a very simple service. It’s boiler plate debt collection. Letters are sent, emails are sent, phone calls made and all over a short time. If nothing comes of it, the debt collector will move on. If you have a particularly troublesome debtor, they will not take the time to review the case legally. While a debt recovery agency cannot represent you in court, we can (if we have the resources) provide legal assessments of cases. We can also advise on escalation and provide a partner or solution for taking further steps. This includes involving high court bailiffs and obtaining CCJs. A no win no fee debt agency has no interest in reaching this stage, the case will be dropped long before the court is a possibility.

In review

The main point to consider when looking for a debt collector is "how hard will they work". If you are happy for a debt collection company to conduct a short strategy, apply a small amount of pressure and see whether the debtor responds or not, no win no fee is an option.

However, if you wish to apply consistent pressure to your debtor. If you wish to overcome disputes or delay tactics, a normal debt collection agency with up-front fees will ensure your debt is worked to exhaustion. It doesn’t matter if your debt is £200 or £200,000. 1 single debtor or 1,000. A personal debt or a business debt. An up-front fee company will take your debt, do all they can to provide a result, advise escalation if necessary, and do all the leg work a no win no fee debt collector won't.

Talk to us

If you’d like to speak to a debt advisor about a debt you wish to recover, discuss how debt collection agencies work and look to apply consistent pressure in pursuit of repayment, you can contact the senior debt advisors at Are You Owed Money Ltd. By phone on 0800 130 3357 or by emailing enquiries@ayom.co.uk. We have a history of collecting all manner of debts, small to large, including from difficult, unresponsive debtors. To chat about how we work and what we can do for you today, simply get in touch.

Remember, no win no fee is the easy option, but a full-service debt collection agency will do the work a no win no fee company never will.

All images used in this post are property of Are You Owed Money Ltd