And why exactly are we needed? Two questions that many creditors ask daily. Even many debtors are always cautious to speak to collections agencies when we are drafted in. This is for several reasons of course with it being a money-based industry. This blog is intended to help clear up a few commons queries regarding debt recovery agencies.

What is a debt recovery agency?

A debt recovery agency is a third party that is enlisted to help recover a debt. We are a form of credit control, with the knowledge needed to help recover money from tricky, non-paying debtors. A debt recovery agency is there to help boost cashflow and overcome stalling tactics. We can also provide backup for objections by being a mediator.

Some debt recovery agencies specialize in specific debt types. These can be commercial, business to business debts, collection of rent, personal debts or corporate debt books. Whatever service is offered, a collection agency aims to make a breakthrough in the repayment process.

AYOM is a general debt recovery agency meaning we will collect debts of all sizes from many different types of clients. This includes large corporate clients including banks and not for profit companies to single, low value debts. We attempt to recover debts for each client using a few successful strategies based on the debt type, amount, situation and more.

Why enlist a debt recovery agency?

This is a subject we could write a blog series on. To cut it short, agencies are there when you need assistance. Many will advertise themselves as the last resort lifeline. However, AYOM doesn’t just want to be there when a creditor as on their last chance. Many AYOM clients are SMEs or people without the capability to chase debts. This can include not having a credit control department or the experience needed to get a result.

If you could use a boost in chasing a difficult debt, don’t struggle in silence. Sometimes debts can be difficult to address, this could be due to personal issues or a breakdown of discourse. Matters of money can be complicated and sometimes heated, making a third party a good option to resolve the matter.

What to check before you choose a debt recovery agency?

Not all debts require the same regulation. However, if your debt is classed as a “consumer debt”, you will need to check for certain licences. The license required by law to collect consumer debts is to be certified by the FCA (financial conduct authority).

The FCA is an independent body aiming to:

- Protect the integrity of the financial industry

- Promote competition in the interest of consumers

- Appropriately protect consumers

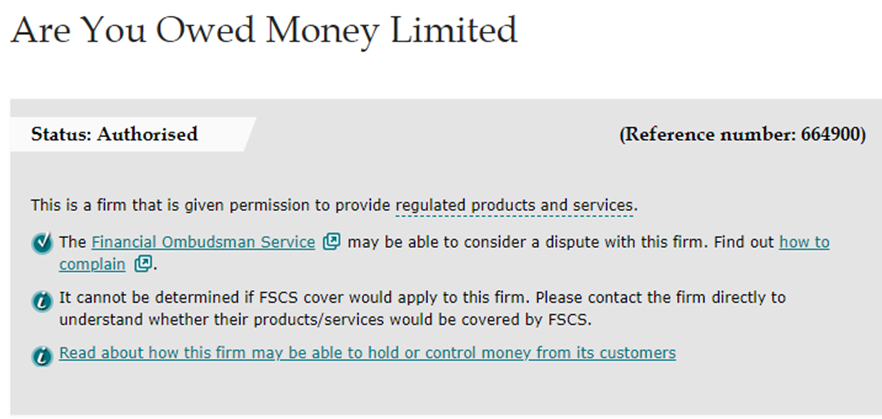

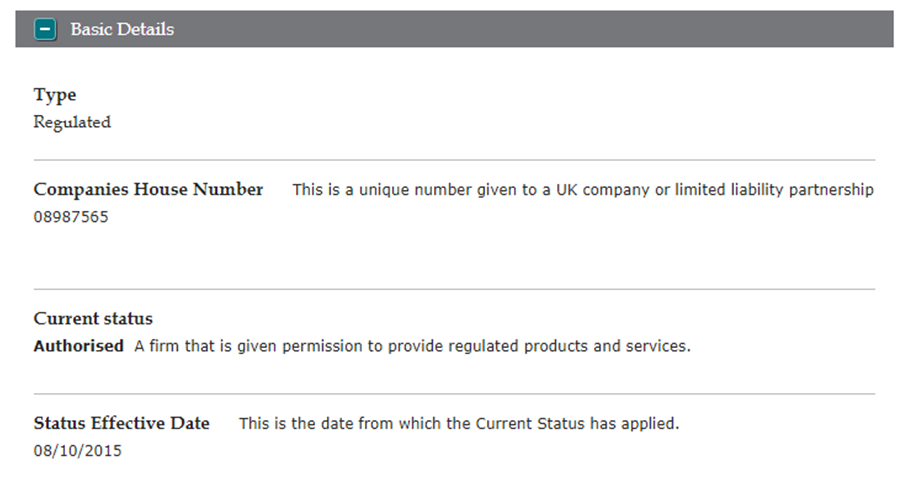

To collect consumer debt, a collection agency must have either “interim permission” or “full permission” to act with consumers. To find out if an agency is certified, you can search the FCA register online (example here). If an agency is not on this register and claims to handle consumer debt, it is advised to avoid and report to the FCA.

Commercial and B2B debts however are not FCA regulated. The best measure of an agency is to check the prestige of their clientele and their testimonials as a measure of success. It is worth checking however if a company is affiliated with any other industry bodies. The Credit Services Association (CSA) is a financial services body which is optional to join unlike the FCA. The CSA has its own best practice guidelines and helps debt recovery agencies stand out from the crowd by agreeing to their tighter codes of conduct. Just like the FCA, you can find an example of searching a company on their register here.

More information on debt recovery agencies

If you would like to know more about the general process of debt recovery, including how AYOM works or could work for your case, get in touch. We are happy to provide information about our FCA licenses and CSA membership, as well as explaining why they benefit the process.

To get in touch with our team at AYOM you can call 0800 130 3357 or email enquiries@ayom.co.uk. Debt recovery can seem a complicated matter especially if the debt is specific to you. Don’t be afraid to ask for free advice and get in touch if you could use assistance. Remember, debt recovery doesn’t have to be a last resort.