Crunch time

The cost-of-living crisis has been big news for some time. Articles covering what it means to everybody are rife. Consumers are being bombarded with information.

What can you do to save money?

What is the best way to tackle it?

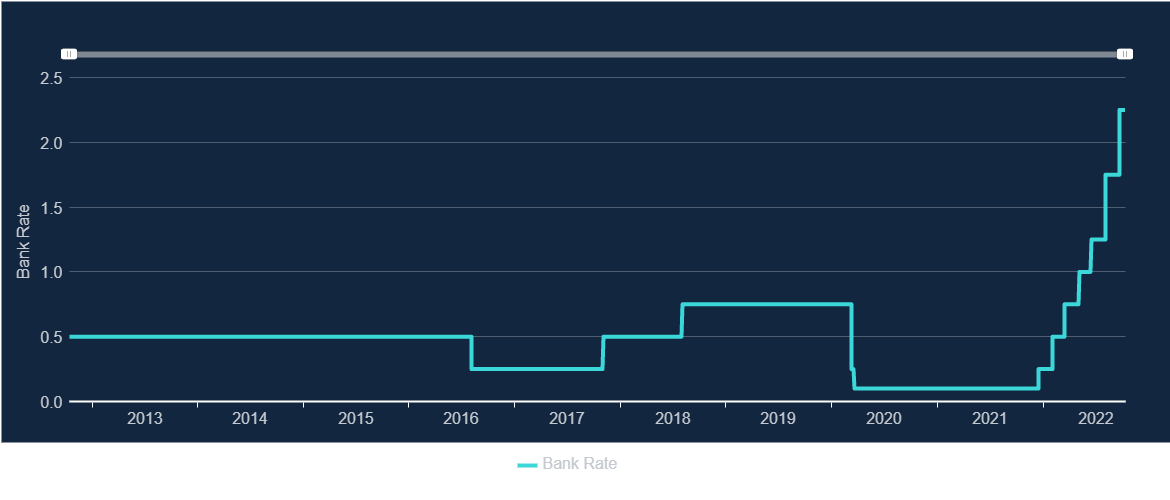

Some of AYOM’s own staff members are facing these issues at present. Some are applying for mortgages, car finance or loans. The bank of England base rate (which has been below 0.75% since before 2013) has consistently increased since January to 2.24%. This means interest rates on borrowing are changing almost daily during the uncertainty.

Most media have reported this and its effect for consumers. This is of course important to all of us; as we are all consumers. However, what about implications for businesses? Will this affect businesses at all levels? If so how?

In short... yes. Any changes to interest rates and the Bank of England base rate will need to be passed on somewhere. Commercial credit has already started to be affected along with commercial energy bills, commercial rent, or terms of contracts.

AYOM investigates.

Passing on rates to lenders

Interest rates on loans for start-ups are highly likely to affect affordability. Many companies that are looking to either get things moving or start to expand may face financial hardship. Jess Christman who owns timber firm Swallowfield Smallholding spoke to the Financial Times about the problem.

His concerns were over loans which were offered to businesses during the Covid pandemic. These loans are now needing to be repaid but repaying those and finding new sources of funding are becoming a problem. Many businesses face the same issue, trying to find sustainable funding in a world of rising rates.

This is likely to also affect bigger businesses, particularly SMEs not in long term contracts over commercial rent. As with consumer rent and mortgages, rising landlord costs may be passed on to the tenants. This could quickly become a problem for businesses who are not already flourishing. Given many companies are only seeing a return to pre pandemic levels now (and some still trying to return to that) it puts many SMEs at risk if rates and interest reach levels beyond affordable.

As commercial debt recovery agents, we have heard many stories like this over the past year. Many AYOM clients end up seeking our services to resolve debts to ensure their cashflow remains strong. It may be one problem that your commercial rent or loans may be rising, but what about your own clients and the money they owe you?

What if my clients fall foul?

The change in rates is just another issue after a series of changing circumstances. In June we published an article about soaring costs following the war in Ukraine. That itself followed the Covid pandemic which all prefaced the current cost of living crisis.

Business debt collection can be a useful tool during this time. When commercial rent, loan repayments and credit is hard to manage, sometimes making sure your own income is in, and on time, can be vital. Debts which slip beyond agreed terms and become difficult to recover could be a sign the debtor is struggling. In times like these, being the first to act may be the difference for your company surviving and thriving.

We firmly believe in the mantra of “the squeaky wheel gets the grease”. Hiring a debt collection agency ensures debtors know they need to pay, and promptly. If they can’t in full, then they must start repaying what they can, immediately.

AYOM serve businesses by conducting debt collection strategies. This is done by applying pressure using various methods to keep your debt at the top of your debtor’s priorities. Where possible, we often look for payment upfront depending on the financial health of the debtor. We do this by doing background checks and investigating. In the event your debtor cannot repay the matter in one payment, we will investigate repayment plans that benefit you. We never accept token payments. It is no good to you as a business to accept payment plans that stretch on years and years into the future.

If even that becomes a problem, there’s further you can go. In some instances, we help clients escalate the matter legally. This can be in obtaining a CCJ and seeking enforcement options. This mostly applies in the more extreme cases. In this current environment, we would advise prompt payment and regular payments.

AYOM's Head of Collections spoke about our more recent client enquiries. She told us:

"We're seeing an increase in SME clients looking to debt collection to ensure their own cashflow stays strong. With many clients seeing their costs increasing whether it be production, rent or their own credit rates, they need what they are owed back, fast. We try to do that to the best of our ability as it can create a logistical chain of non-payment."

Finding a suitable solution

The primary function of a business debt collection agency is to find a suitable solution. Every debt is different, and it depends on many factors.

- What is the debt value?

- How many debts are there?

- Has it already had a CCJ?

- How much evidence/ paperwork is there?

- What is the relationship between the parties?

These factors govern how we approach our strategy. If you are a UK based business looking for help, our team can advise. Our debt recovery advisers can ascertain your chances of success and help. With rates rising, costs rising and SMEs bearing the brunt just as consumers, now is a good time to get on top of cashflow and ensure what is owed to you, comes back to you.

To get in touch with an expert, you can email enquiries@ayom.co.uk or call 0800 130 3357 for more information.

Banner Image:

Our Use |

Source |

Expect Best

Thumbnail Image:

Our Use |

Source |

David Iliff |

License: CC BY-SA 3.0

Article Image(s):

Our Use |

Source |

Bank of England

Our Use |

Source |

Tiger Lily