Back in January, Rishi Sunak unveiled a 5-point plan. This plan sought to address key issues to putting the UK ‘back on track’. In this plan, halving inflation and reducing national debt were high priorities. With both these potentially affecting on UK business, AYOM looks at current progress.

Sunak’s plan

As part of Rishi’s plan, 2 key elements stuck out to AYOM:

- “Halve inflation this year to ease the cost of living and give people financial security.”

- “Reduce debt so we can secure the future of public services.”

Inflation in the UK

Inflation is a common part of economics. It is a simple measure of how much prices of goods and services rise over time. High inflation means our money doesn’t go as far. Inflation helps economies by encouraging spending. If prices are expected to rise, buyers would be encouraged to do so before prices rise.

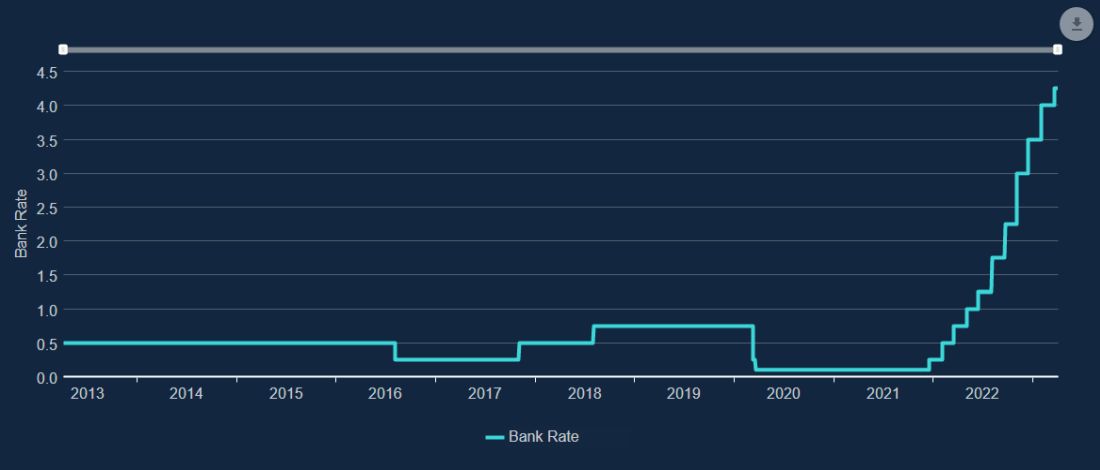

Inflation is heavily related to interest rates. The Bank of England (BoE) may alter the base rate up or down to encourage or discourage spending. Since 2007, the base rate has been very low. However, since December 2021, the base rate has increased well over 4% to 4.25%. This is the first time it’s been as high since October 2008 to combat the financial crisis.

Rising prices affects more than just consumers. As we’ve experienced recently, it can have major affects across business and economics. The cost of natural materials can quickly increase dependant on demand, making every day running tougher for any business.

UK national debt

While the national debt is not intrinsically linked to economic growth, there are arguments about its effects. One argument regarding "crowding out" conveys that high government borrowing leads to lower private sector investments and spending. It is also argued high government borrowing may lead to higher interest rates. If interest rates do rise because of high government debt, this will make borrowing more expensive.

A current watch of the UK's debt clock shows a staggering £2bn+ amount owed by the UK government. This equates to £45,000 per citizen and £77,000 per taxpayer. It is estimated the UK’s interest alone on these debts totals over £71m+ per year with debt at 120% of GDP.

Are businesses coping?

Early statistics for 2023 indicate businesses are struggling. In January, 1,382 businesses entered voluntary liquidation. This was added to with 189 compulsory liquidations. It is 11% higher than January 2020 and 7% higher than January 2022.

It’s no secret that businesses are feeling the pinch. Back in October we wrote about how the BoE interest rates had already affected SMEs. At the time we were still only at 2%, but with that rate doubling since, it is a worrying time for some. Added to that, our blog suggesting GDP is predicted to shrink in 2023, now is the time to get on top of cashflow.

With the next UK General Election slated to be in 2025, there is time for the Conservatives to make headway on their plan. Will the PM and his team be able to live up to their targets? With Russia’s involvement with Ukraine still pressing, the cost of living still affecting many and economic forecasts looking pessimistic, it will be difficult.

The political landscape is always tumultuous. Opposition members remain vocal, the media and population sceptical. It would take a concerted effort to achieve all the points on Rishi’s plan. Broadly speaking, each point will go some way to helping achieve the others and so time will be the best judge of the plan’s viability. AYOM, SMEs and British businesses should remain hopeful as a successful implementation could help you bloom. If, however Rishi struggles, it will be up to business owners to take action for themselves.

If you are experiencing rising costs and are worried about outstanding invoices, our advice is to act fast. On average the best chances of recovering debts are when they are newer. This is because it is still fresh in the mind of the debtor and time is on your side. Getting to work early limits delay tactics and excuses that may occur if a debt is left alone.

If your business is beginning to see signs of clients withholding payment for whatever reason, get in touch. AYOM’s team of experts can advise for free what options are available. These often vary depending on the size, age, and scope of the debt. To obtain a free consultation, simply email enquiries@ayom.co.uk or call 0800 130 3357 to speak to our team.

Banner Image:

Our Use |

Source

Attribution: Expect Best | License: Pexels: Free to use

Thumbnail Image:

Our Use |

Source

Attribution: Simon Walker / HM Treasury | License: Open Government Licence v3.0

Article Image:

Our Use |

Source

Attribution:

Conservative Party Website | License: Terms of Use

Article Image: Our Use |

Source

Attribution:

Governor and Company of the Bank of England | License: Legal (Terms of Use)

Article Image: Our Use |

Source

Attribution:

Scott Graham | License: Unsplash