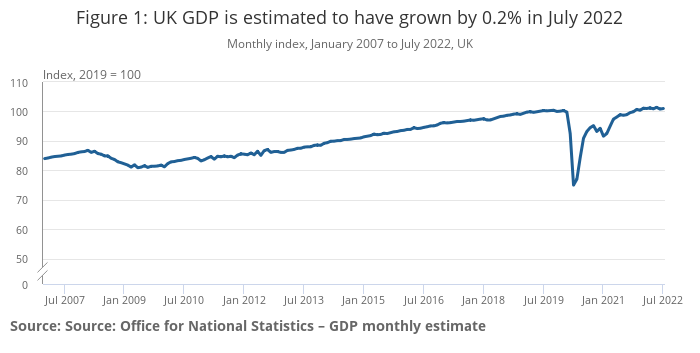

Despite worries over costs of living, the UK showed a surprise growth of GDP in July. It follows a 0.6% decline June and while welcome, doesn't look to be a good omen of growth to come. According to industry sources, UK GDP had a "flat 3 months" before the July upturn. The main drivers include the service sector, but a slowdown is predicted as we move into Autumn. For businesses offering credit at this time, the predicted slowdown suggests caution is advised.

Non-service industries fall

The 0.2% rise was helped by a strong month for the service industry. The women's European Championship sparked plenty of national interest. The competition saw visitors travel to the UK and games attended by tens of thousands. A proud moment for the sport saw over 87,000 fans pack Wembley for the showcase final. The fanfare surrounding the tournament spelled a good month for the service industry.

However, many other industries weren't as positive. Notable declines during the month included production (-0.3%) and construction (-0.8%). It is thought the growing concern over cost of living alongside electric and gas supplies are fuelling the decline. Experts also predict that the upturn will not last. Many companies are gearing up for some tough months ahead. The bank of England confirmed the uptick should be taken with a pinch of salt. The bank has not altered monetary policy resulting from the 0.2% increase.

Industry experts have commented on the potential downturn expected in the coming months. KPMG’s Chief Economist, Yael Slefin told press:

"This ties into a downbeat outlook for the UK economy. It could see another shallow recession from the end of this year. It will be driven by the ongoing squeeze on households' income and a rising cost burden for businesses."

Adding to this, Marcus Brookes, CIO at Quilter Investors added:

"Ultimately, the next few months are still likely to be a very difficult environment for everyone. This includes governments, corporate entities, and households alike. Quality businesses continue to be those likely to do best during this challenging time. For investors this may be an area they wish to explore to help them navigate this tricky period."

Caution with credit

What does the outlook mean for debts? AYOM's advice is to be "cautious with credit". Businesses should continue to trade and offer credit but do so on favourable terms. We recently published an article about evidence and paper trails. In the article we discussed how contracts, evidence and clear agreements alleviate the risk when offering credit. Even if the economic situation is not as hoped, it shouldn’t hamper confidence in conducting business.

Using Brookes' advice regarding "quality" businesses could be key. When trading using credit, B2B entities would be wise to do proper due diligence. Working with trusted, quality businesses will reduce risks of non-payments.

AYOM's head of commercial debt spoke to us about the business debt collection process. They said:

“Many businesses (especially SMEs) worry about predicted slow periods of GDP. We often see cases on non-payment in the business sphere rise. Giving responsible credit is a good step towards maintaining a solid relationship and cashflow. Working with businesses you know and trust, alongside keeping relevant paperwork keeps you in a strong position.”

“Having set terms dependent on levels of trust/ amount of credit on offer will also keep you protected. If even these see you fall short, there is the safety net of instructing a business debt recovery agency.”

AYOM recently wrote about how business debt recovery agencies assist B2B matters. The reminders and pressure applied alongside evidence provided can be reassurance you need. It is evidence you do not need to allow the economic outlook to hinder your business.

Debt collection safety net

With the economy predicted to be the slowest growth in the G7 next year, businesses are right to be cautious. While not a reason to panic, realism and keeping a level head will be required. Growth is still predicted to rise, but slowly. If your business falls foul of non-payment a business debt collection agency will be useful. Enlisting them could see you benefit from a helping hand to keep cashflow positive.

Business debt is very different to consumer credit. It establishes both sides as equals and operates within clear regulations. If you are a business with unpaid debts requiring collection, utilise your safety net. he last thing any business will wish to do during slow growth periods is spend time on non-business critical work. A business debt collection agency can allow you to spend time generating new work and clients. Meanwhile, the agency can concern themselves with your cashflow.

While the outlook is slow growth, we must remember it is still growth. Avoiding a recession requires businesses to do their best to thrive. What makes your business great? Spending your Q4 developing and growing may be the difference between thriving and simply surviving.

To get in touch with an expert, you can email enquiries@ayom.co.uk or call 0800 130 3357 for more information. Our advisers have worked with businesses of all sizes. We not only reunite them with money from unpaid invoices but help to maintain positive cashflow and relationships.

Guarantee a professional, fast approach to credit control with Are You Owed Money Ltd.

Banner Image:

Our Use |

Source |

Mitch Rosen

Thumbnail Image:

Our Use |

Source |

Olga Lioncat

Article Image(s):

Our Use |

Source |

ONS / UK Government

Our Use |

Source |

Kateryna Babaieva